|

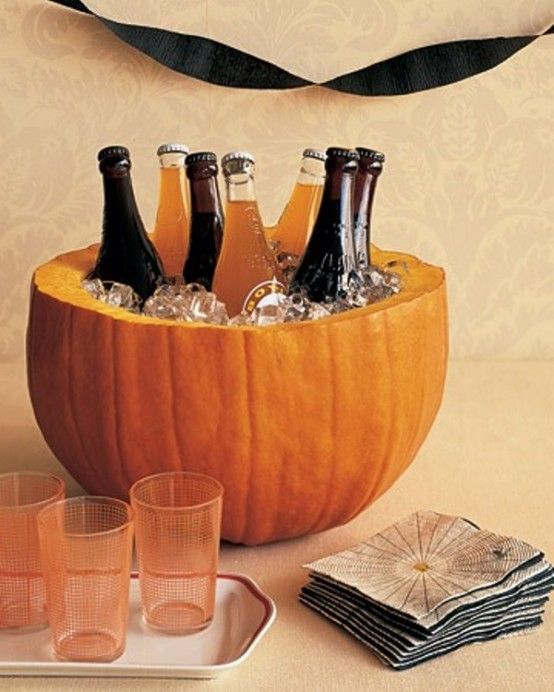

CHEERS to a Great Halloween!

Don't get SPOOKED by the raise in rates,

the time to buy is NOW!!

Looking for Ideas? Here are some Halloween Decorating Ideas.

10 Tips for Adding Value to Your Home

- Remodel the kitchen: It's the heart of the house. And it can give you close to a 75% return on your investment!* (Make sure you get the proper permits for any improvements that involve construction!)

- Update or add bathrooms: A master suite with his and her sinks, spacious showers and plenty of square footage are what buyers are looking for.

- Remodel the basement: It can easily be turned into a rec room, bar, media room or extra bedroom. Be sure to include a bathroom.

- Landscape: A good design can add as much to your home's value as a new kitchen or bath. Have a qualified landscape architect offer suggestions.

- Paint: We're talking inside and out. People crave color today so don't be afraid to consider a wide range of hues.

- Add a deck: More than 77% of your wooden deck's cost can be recouped when you sell!*

- Add a sunroom: It's a way to increase square footage for less than half the cost of a standard room.

- Improve curb appeal: Fix any broken or flaking shutters. Paving a pitted driveway or walkway is a must, and sprucing up decks or patios works wonders.

- Add a home office: The growing number of telecommuters has made a home office more of a necessity than a luxury. It also makes your telecommute tax deductible.

- Add space and light: If your house has small rooms that block the flow of natural light, consider knocking down some walls and opening up your floor plan. Also, if your bedrooms are small, think about adding a master bedroom.

|

|

|

Look at other ways to add value to your home.

|

|

|

|

5 Home Inspection Red Flags

A home inspection is a buyer's opportunity to see if any problems lurk that may prove expensive to fix later. Home inspections nearly always uncover something in a home to watch for or minor repairs needed. But what repairs should buyers especially be alarmed about that could possibly send them back to the negotiation table? Tom Kraeutler of The Money Pit, a nationally syndicated radio show on home improvement, points out some of the following home inspection red flags:

1. Termites and Pests: The sooner termites are detected, and steps can be taken to get rid of them the better.

2. Drainage Issues: A home that has poor drainage can have wood rot and wet basements and crawlspaces, which can then lead to major mold growth.

3. Mold: Pervasive mold growth may indicate an issue with improper ventilation issues and can also cause health issus to those living in the home.

4. Faulty foundations: A cracked or crumbling foundation could be a very expensive repair.

5. Wiring issues: Outdated wiring or overloaded circuits can pose a fire hazard.

10 Percent Down Making a Comeback?

The 10 percent down payment may be back. Reportedly, some lenders are offering 90% financing once again on all loan types. RPM Mortgage, based in San Francisco, resumed its "piggyback" loans in the first quarter of this year. The company had put its piggyback loans on hiatus in late 2007 during the financial crisis. A piggyback loan allows a borrower to put down 10% without having to pay private morgage insurance. The last few years lenders have tightened up their

underwriting standards and raised their downpayment requirements, mostly by enforcing a minimum of 20% down. That has kept some buyers on the sidelines. But certain lenders say they're starting to cautiously ease up as home prices rise and the market continues to pick up. However, Julian Hebron, VP of RPM Mortgage, says to qualify for a 10% down payment, applicants must still meet some high standards. For example, they must have a credit score above 700 and monthly housing, car, student loan, and credit card debt that is no higher than 45% of their earnings. In some cases, lenders are reportedly allowing borrowers to come with down payments as little as 5%, although those tend to come with private mortgage insurance on conforming loans that are less than $417,000 and are reserved for the most credit-worthy borrowers.

Have more mortgage questions? Ask Michael Cao, with Village Bank.

|

|

|