Catherine M. Censullo CPA

One Minute Tax Tip

|

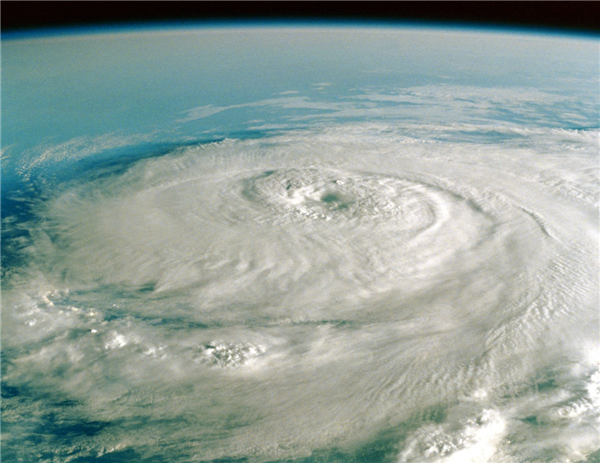

DID YOU KNOW THAT IT IS COMMON FOR SCAM ARTISTS TO IMPERSONATE CHARITIES AFTER MAJOR DISASTERS?

Such fraudulent schemes to get money or private information from well-intentioned taxpayers may come to you by telephone, social media, e-mail, or in-person solicitations.

To help you avoid becoming a victim in your desire to help those in need, the IRS has issued the following tips to help you avoid getting

scammed:

- You should donate to recognized charities to help disaster victims.

- You should be wary of charities with names that are similar to familiar or nationally known organizations. Some phony charities use names or websites that sound or look like those of respected, legitimate organizations.

- You can verify legitimate charities on the FEMA website or by going to the irs.gov website and searching for "Exempt Organizations Select Check".

- You should never give out your personal financial information such as Social Security numbers, credit card numbers or bank account numbers and passwords.

- You should never send cash. Contribute by check or credit card to provide documentation for deducting the gift.

- You can reference IRS Publication 526, Charitable Contributions, to find out the kinds of organizations that can receive deductible contributions.

- You can go to the IRS website and search for "Report Phishing" if you suspect a fraud. You can also find more information if you search for "scams and schemes".

You should not let these scams stop you from donating to this worthy cause. You should just make sure you do it smartly and safely.

If you need any help, do not hesitate to call the office at 914-997-7724.

|

|

|

|

Catherine M. Censullo, CPA

914.997.7724

catherine.censullo@cmcensullocpa.com

Images ©Encore Software, Inc., and its licensors. All rights reserved.

Images may not be saved or

downloaded and are only to be used for viewing purposes.

|

|